#Automated Sortation System

Explore tagged Tumblr posts

Text

Automated Sortation System Market Outlook from 2024 to 2034

The global automated sortation system market is expected to reach USD 9.3 billion in 2024, with a projected CAGR of 8.8% from 2024 to 2034. By 2034, it is anticipated to grow to USD 21.7 billion. A year-over-year growth of 7.9% is forecast for 2024.

Browse More: https://www.futuremarketinsights.com/reports/automated-sortation-system-market

0 notes

Text

Efficient Warehousing Starts with the Right Pallet Dispenser

In modern warehousing and logistics, efficiency is no longer optional—it’s essential. A key component in streamlining material handling operations is the pallet dispenser. Often working in tandem with a pallet stacker, this equipment automates one of the most overlooked steps in warehouse workflows: dispensing and stacking pallets.

What Is a Pallet Dispenser?

A pallet dispenser is a mechanical device designed to automatically release or stack pallets without the need for manual handling. Commonly used in distribution centers, manufacturing plants, and packaging lines, these machines reduce downtime and improve worker safety by minimizing manual lifting.

Pallet dispensers can handle wooden, plastic, and sometimes even metal pallets, and they come in various configurations—floor-mounted, overhead, or integrated into conveyor systems.

Why Warehouses Are Turning to Pallet Dispensers

As labor shortages and operational costs continue to impact supply chain dynamics, automation is becoming an integral part of warehouse optimization. Pallet dispensers, when combined with pallet stackers, can lead to significant improvements in:

Productivity: Continuous feed of pallets eliminates manual placement delays.

Safety: Reduces the risk of injuries related to lifting and moving heavy pallets.

Consistency: Ensures uniform pallet handling, reducing operational errors.

“Since we implemented a pallet dispenser and stacker combo, our warehouse throughput has improved by nearly 30%. It’s reduced both idle time and workplace injuries.” — Carlos M., Logistics Manager, Northern Freight Solutions

Pallet Dispenser vs. Pallet Stacker: Understanding the Difference

While both are used in handling pallets, their functions differ:

Integrating both systems creates a closed-loop pallet management solution, minimizing idle time and maximizing operational flow.

Use Cases Across Industries

Pallet dispensers are not industry-specific. They are used in:

Food & Beverage: For maintaining hygiene and preventing contamination through minimal contact.

Pharmaceuticals: Ensuring consistent pallet availability during automated packaging.

Retail Distribution: Speeding up order fulfillment operations.

Automotive: Managing heavy-duty pallets for parts and components.

How to Choose the Right Pallet Dispenser

Selecting the ideal pallet dispenser depends on several operational factors:

Pallet Type and Size: Compatibility with standard or custom pallet dimensions.

Capacity: Number of pallets handled per cycle or per hour.

Integration Requirements: Whether it needs to work alongside conveyors, robots, or pallet stackers.

Space Constraints: Floor-mounted vs. overhead models depending on available warehouse space.

“Choosing a dispenser that integrates easily with our conveyor line made a significant difference. It wasn’t just about the machine—it was about how well it fit into our existing layout.” — Stephanie T., Plant Supervisor, Midstate Manufacturing Co.

Maintenance and Lifecycle Cost

Though typically low-maintenance, routine checks on mechanical parts, sensors, and hydraulic components are essential for longevity. Many dispensers offer diagnostics features to alert users of wear and tear, further reducing downtime.

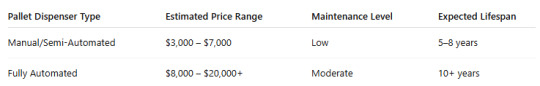

Here’s a general overview of cost expectations: Pallet Dispenser

Final Thoughts

For operations seeking to reduce manual labor, enhance safety, and improve throughput, a pallet dispenser paired with a pallet stacker offers a robust, scalable solution. With proven applications across diverse industries, it's clear that these machines are more than just convenience—they're a strategic investment in productivity.

0 notes

Text

Saudi Arabia Warehouse Automation Market Share, Size, Technologies, Growth Strategy, Challenges and Future Competition Till 2033: SPER Market Research

Warehouse automation encompasses the implementation of technology and systems designed to enhance and optimize various operations within a warehouse, such as inventory management, order fulfilment, and material handling. This automation can range from basic conveyor systems to sophisticated robotics and software solutions that manage tasks with limited human involvement. The main objective is to improve operational efficiency, lower labour expenses, and increase accuracy in the handling of goods. Automated Storage and Retrieval Systems (AS/RS) are vital in facilitating the swift storage and retrieval of items. As e-commerce continues to expand, the importance of warehouse automation grows, becoming critical for satisfying consumer demands and sustaining competitive advantages in supply chain management.

According to SPER Market Research, ‘Saudi Arabia Warehouse Automation Market Size- By Type, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2033' states that the Saudi Arabia Warehouse Automation Market is estimated to reach XX Billion by 2033 with a CAGR of XX %.

DRIVERS:

The swift growth of the e-commerce industry serves as a significant catalyst, driving the demand for effective storage and distribution systems to satisfy the rising consumer expectations for prompt delivery and efficient inventory management. Persistent labour shortages are compelling organizations to implement automated solutions to sustain productivity while decreasing dependence on human labour. The escalating requirement for cold storage facilities, especially within the food and pharmaceutical industries, is generating prospects for specialized automated solutions. Advancements in automation technologies, including robotics, artificial intelligence (AI), and cloud-based warehouse management systems, are enhancing operational efficiency and lowering expenses. A surge in the e-commerce sector is significantly driving the demand for warehouse automation. The warehouse automation market is marked by a highly competitive environment.

RESTRAINTS:

The initial capital needed for warehouse automation technologies, including robotics and automated systems, can be considerable. This financial hurdle may discourage smaller enterprises from embracing these solutions, thereby constraining overall market expansion. There exists a notable demand for skilled individuals who can operate and maintain sophisticated automation systems. The existing shortage of qualified personnel in Saudi Arabia presents a challenge for organizations aiming to implement these technologies successfully. Additionally, employees and management may be hesitant to shift from conventional manual processes to automated systems due to concerns about job security or a lack of familiarity with new technologies. Addressing this resistance necessitates the implementation of effective change management strategies and comprehensive employee training.

Request a Free Sample Report: https://www.sperresearch.com/report-store/saudi-arabia-warehouse-automation-market.aspx?sample=1

The rise of e-commerce during the pandemic prompted a need for enhanced operational efficiency within warehouses. Organizations pursued automation solutions to handle the surge in order volumes and to satisfy consumer demands for quicker delivery times, thereby propelling growth in the warehouse automation industry. The pandemic also resulted in significant disruptions to global supply chains, impacting the availability of essential components and materials required for the implementation of automation technologies. Consequently, businesses aiming to automate their operations faced project delays and increased costs. Although the long-term prospects of warehouse automation remain promising, certain companies displayed hesitance in capital investments due to economic uncertainties and a decline in consumer spending during the pandemic.

The market for Saudi Arabia warehouse automation is dominated by Eastern region because of its support in industrial activities and logistics operations, contributing to the overall growth of the market. Some of its key players are- ABB Ltd, Vanderlande, Toyota Industries Corporation, Murata Machinery, Honeywell International Inc.

For More Information, refer to below link: –

Saudi Arabia Warehouse Automation Market

Related Reports:

Flying Car Market Size- By Product, By Capacity- Regional Outlook, Competitive Strategies and Segment Forecast to 2034 Spark and Glow Plugs Market Growth, Size, Trends Analysis - By Vehicle Type, By Fuel Type, By Spark Plug Type, By Aftertreatment System, By Technology- Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Automated Sortation Systems Supplier in KSA#Automated Technology in Warehousing KSA#Competitors in KSA Warehouse Automation Industry#Emerging Companies in Warehouse Automation KSA#International Domestic Freight Forwarders in KSA#KSA automated technology software Market#KSA Automatic Guided Vehicle Market#KSA Logistics and Warehouse Automation Market#KSA Logistics and Warehouse Automation Market Report#KSA Logistics and Warehouse Automation Market Share#KSA Logistics and Warehouse Automation Market Trends#KSA Warehouse Automation Industry#KSA Warehouse Automation Industry Analysis

0 notes

Text

Warehouse Automation Sortation System

Transform warehouses with Adverb's material movement, sortation, picking, storage, and reverse logistics solutions. Mobile robots, ASRS, and software cater to pharma, e-commerce, grocery, cold storage, solar, and battery industries.

#Warehouse and Sortation Associates#Warehouse Sortation Solutions#Warehouse Automation Sortation System

0 notes

Link

0 notes

Text

Automated Warehouse Systems: Revolutionizing Supply Chain Efficiency

Introduction

In the rapidly evolving world of logistics and supply chain management, automated warehouse systems have emerged as a transformative solution. From streamlining operations to enhancing productivity, automation is redefining how warehouses function. With rising customer expectations and global e-commerce expansion, businesses are increasingly turning to automation to remain competitive and agile.

What Are Automated Warehouse Systems?

Automated warehouse systems are technology-driven solutions that perform warehousing functions—such as storage, retrieval, sorting, and packaging—with minimal human intervention. These systems integrate hardware like automated storage and retrieval systems (AS/RS), conveyor belts, robotic arms, and automated guided vehicles (AGVs) with intelligent software to manage inventory and workflows efficiently.

Key Components of Warehouse Automation

Automated Storage and Retrieval Systems (AS/RS): Mechanized systems that place and retrieve goods from specific locations in the warehouse, improving storage density and speed.

Robotics and AGVs: Robots and self-driving vehicles transport goods throughout the warehouse, reducing the need for forklifts or manual labor.

Warehouse Management Systems (WMS): Software platforms that coordinate data, monitor inventory, and optimize task assignments in real-time.

Sortation Systems: High-speed sorters classify and direct items to their respective locations, essential for handling thousands of parcels daily.

Conveyor Systems: Automated conveyors streamline movement across packing, picking, and shipping stations.

Benefits of Automated Warehouse Systems

Increased Efficiency: Automation significantly reduces picking and handling time, allowing warehouses to process more orders faster.

Enhanced Accuracy: With advanced sensors and tracking systems, errors in inventory management and order fulfillment drop dramatically.

Lower Operational Costs: While initial investment may be high, automation reduces long-term labor and operational costs.

Scalability: Automated systems can easily adapt to demand fluctuations and business growth.

Improved Safety: By minimizing manual handling and using robots for repetitive or heavy tasks, workplace injuries are reduced.

Challenges in Implementing Automation

High Initial Investment: The upfront cost for equipment, software, and integration can be substantial.

Technical Complexity: Requires skilled professionals for maintenance, troubleshooting, and optimization.

Change Management: Employees may need to be retrained, and workflows must be adapted to new systems.

Real-World Applications

E-commerce Fulfillment Centers: Giants like Amazon and Alibaba use automated warehouses to manage millions of orders daily.

Cold Storage Facilities: Automation ensures fast, efficient handling in temperature-sensitive environments.

Pharmaceutical and Healthcare Logistics: Ensures accuracy, compliance, and timely delivery of sensitive medical supplies.

The Future of Warehouse Automation

The future looks promising with the rise of AI, machine learning, and IoT-enabled devices enhancing automation capabilities. Predictive analytics, real-time data monitoring, and fully autonomous operations are set to become standard in modern warehouse facilities.

Conclusion

Automated warehouse systems are not just a trend—they are the future of efficient, reliable, and scalable logistics. As technology advances and market demands grow, automation will play a critical role in ensuring operational excellence across the supply chain.

0 notes

Text

0 notes

Text

Global Logistics Automation Market is projected to reach the value of USD 55.36 billion by 2030.

Global Logistics Automation Market is projected to reach the value of USD 55.36 billion by 2030.

logistics automation market crossed USD 34 billion, with automated solutions cutting operational costs by an average of 28% across industries. Companies deploying end-to-end automation reported a 29.3% boost in warehouse productivity within the first year alone. Autonomous Mobile Robots (AMRs) surged by 34% year-on-year, reshaping warehouse layouts with flexible, scalable operations.

With e-commerce order volumes growing 5x faster than traditional retail and labor shortages driving logistics costs up by over 18%, automated systems have shifted from a “nice-to-have” to a “must-have” for competitive survival.

This report offers actionable segmentation by component, automation type, and end-user industry; uncovers pricing trends; analyzes deployment models; and provides country-specific insights including North America, Asia-Pacific, and Europe.

2025–2030 marks a critical window. Companies acting now can secure operational advantages, reduce risks, and achieve 3–5x faster returns on automation investments compared to late adopters.

Download Sample @ https://tinyurl.com/cuwv5ahk

The logistics automation market has experienced remarkable growth in 2024, revolutionizing supply chain operations across industries through advanced technological integration. This transformation is characterized by the increasing adoption of robotics, artificial intelligence, warehouse management systems, and autonomous vehicles designed to streamline logistics processes. Companies worldwide are recognizing the competitive advantages offered by automation technologies, including enhanced operational efficiency, reduced labor costs, and improved accuracy in inventory management. The market is witnessing a significant shift from traditional manual processes to sophisticated automated solutions that can handle complex logistics tasks with minimal human intervention. The current market landscape reflects a strong emphasis on end-to-end automation solutions that provide seamless connectivity between different stages of the supply chain. Major industry players are focusing on developing integrated platforms that combine various automation technologies to offer comprehensive logistics management capabilities. The rise of e-commerce has been a pivotal factor driving demand for logistics automation, as businesses strive to meet increasingly stringent customer expectations regarding delivery speed and accuracy. Additionally, the push toward sustainability has influenced market growth, with automated systems demonstrating superior energy efficiency and reduced environmental impact compared to conventional methods. In 2024, small and medium-sized enterprises (SMEs) have become more prominent participants in the logistics automation market, facilitated by the availability of scalable and cost-effective solutions. Cloud-based logistics automation platforms have gained substantial traction, enabling businesses of all sizes to access advanced capabilities without significant upfront investments.

Key Market Insights:

Studies indicate that companies implementing comprehensive logistics automation solutions report an average productivity increase of 29.3% within the first year of deployment. The adoption rate of automated guided vehicles (AGVs) has surged by 47% in 2024 compared to the previous year, reflecting the growing preference for mobile robotics in warehouse environments.

Approximately 62% of logistics providers are currently utilizing some form of artificial intelligence to optimize route planning and inventory management.

Automated sortation systems have demonstrated an impressive 32.6% reduction in order processing time across industries.

The pharmaceutical sector has emerged as a significant adopter of logistics automation, with 71.5% of pharmaceutical companies investing in automated storage and retrieval systems.

Market Drivers:

Increasing E-commerce Demands

The explosive growth of e-commerce has fundamentally transformed consumer expectations around delivery speed, accuracy, and flexibility, creating unprecedented pressures on supply chain operations. Modern consumers demand same-day or next-day delivery options, accurate order fulfilment, and real-time tracking capabilities — requirements that are virtually impossible to meet consistently through manual processes alone. Logistics automation technologies address these challenges directly by enabling high-speed order processing, reducing picking errors through guided systems, and facilitating rapid sortation and dispatch operations. The ability to handle high-volume, high-variety order profiles efficiently has become essential for e-commerce success, particularly during peak seasons when order volumes can increase exponentially. Additionally, the rise of omnichannel retail strategies requires seamless integration between physical and online sales channels, necessitating sophisticated automated inventory management systems that maintain accurate stock visibility across all points of sale. Companies leveraging advanced logistics automation have demonstrated their ability to reduce order fulfilment times by up to 70% while simultaneously improving accuracy rates to over 99.9%, creating significant competitive advantages in the rapidly evolving e-commerce landscape.

Labor Shortages and Rising Costs

The logistics industry is facing severe workforce challenges characterized by persistent labor shortages, high turnover rates, and steadily increasing wage costs, creating compelling incentives for automation adoption. In many developed markets, logistics operations struggle to attract and retain qualified personnel for physically demanding roles in warehouses and distribution centers, particularly for night shifts and peak seasons. This workforce gap has been exacerbated by demographic shifts including aging populations and changing career preferences among younger workers. The financial implications are substantial, with labor typically representing 50–70% of operational costs in traditional logistics facilities. Automation technologies directly address these challenges by reducing dependence on manual labour while improving working conditions for remaining staff. Tasks that once required extensive human intervention — such as heavy lifting, repetitive picking, and long-distance walking within facilities — can now be performed by automated systems operating continuously without fatigue or performance variation. This transition allows human workers to be reallocated to higher-value roles requiring judgment and problem-solving skills, often resulting in increased job satisfaction and reduced turnover. The economic case for automation becomes increasingly compelling as labour costs rise, with many companies reporting that automation investments reach positive ROI significantly faster in regions with high labour costs.

Market Restraints and Challenges:

The logistics automation market faces significant barriers including high initial investment requirements and technical integration complexities. Many existing facilities require extensive structural modifications to accommodate automation systems, increasing implementation costs. Legacy IT systems often prove incompatible with modern automation platforms, necessitating additional investments in digital infrastructure. Furthermore, workforce resistance and training requirements can delay adoption and reduce projected returns, particularly in organizations with limited change management capabilities.

Market Opportunities:

Emerging technologies including artificial intelligence and machine learning present substantial opportunities for predictive logistics optimization. The growing middle class in developing regions is driving demand for efficient distribution networks, creating new markets for automation solutions. Sustainability initiatives provide openings for energy-efficient automation systems that reduce environmental impact while improving operational efficiency. Additionally, the increasing availability of automation-as-a-service models is making sophisticated technologies accessible to smaller organizations, significantly expanding the potential customer base for logistics automation providers.

Buy Now @ https://tinyurl.com/bdet4j3k

Market Segmentation:

By Component:

Hardware: • Automated Storage and Retrieval Systems (AS/RS) • Conveyor Systems • Sortation Systems • Palletizing and Depalletizing Systems • Robotic Picking and Packing Systems • Automated Guided Vehicles (AGVs) • Autonomous Mobile Robots (AMRs) • Industrial Sensors • Barcode and RFID Scanners • Others (Cranes, Carousels, Shuttle Systems) Software: • Warehouse Management Systems (WMS) • Transportation Management Systems (TMS) • Yard Management Systems (YMS) • Inventory Management Systems • Order Management Systems • Others (Fleet Management, Labor Management Software) Services: • Consulting • System Integration and Deployment • Support and Maintenance

Autonomous Mobile Robots represent the fastest-growing hardware component within logistics automation, experiencing 34% year-over-year growth. Unlike fixed automation or traditional AGVs, these flexible systems require minimal infrastructure modifications and can be rapidly deployed and reconfigured. AMRs leverage advanced navigation capabilities, machine learning, and sophisticated sensor arrays to navigate dynamic environments without predefined paths. Their modular design and scalable implementation allow organizations to start with limited deployments and expand incrementally, creating adoption advantages for operations with uncertain future requirements or space constraints.

Warehouse Management Systems maintain their position as the dominant software component within logistics automation, representing approximately 43% of total software expenditures. These systems serve as the central nervous system for automated operations, orchestrating workflows, resource allocation, and information flows across diverse automation technologies. WMS functionality has expanded beyond inventory control to incorporate sophisticated optimization algorithms, labor management, yard operations, and seamless integration with enterprise systems. Cloud-based deployment models have democratized access to enterprise-grade capabilities, accelerating adoption across organization sizes. The strategic importance of WMS continues to grow as automation complexity increases, requiring sophisticated coordination between human operators and diverse automated systems.

By End-Use Industry:

• Retail and E-commerce • Manufacturing • Automotive • Healthcare and Pharmaceuticals • Food and Beverages • Aerospace and Defense • Consumer Electronics • Logistics and Transportation • Others (Textiles, Chemicals, Oil & Gas)

0 notes

Text

Warehouse Automation Market Growth Driven by E-commerce Expansion and Smart Logistics Integration Globally

In recent years, warehouse automation has emerged as a critical component of modern supply chain management. With global commerce expanding and customer expectations rising, businesses are under increasing pressure to enhance efficiency, reduce errors, and streamline operations. The warehouse automation market has responded to this demand with innovative technologies that are reshaping the way goods are stored, sorted, picked, and shipped.

The Driving Forces Behind Warehouse Automation

The surge in e-commerce has been one of the most significant catalysts for warehouse automation. Consumers now expect rapid order fulfillment and real-time tracking, which necessitates precise inventory management and faster logistics. Manual processes, while still common in many warehouses, can no longer keep pace with the volume and speed of modern retail. Automation technologies fill this gap by providing scalable, data-driven solutions that improve accuracy and throughput.

Labor shortages have also played a role in accelerating automation adoption. Warehousing jobs often involve repetitive tasks and physically demanding work, leading to high turnover rates and recruitment challenges. Automated systems such as robotic arms, automated guided vehicles (AGVs), and autonomous mobile robots (AMRs) can handle these tasks efficiently while reducing the dependency on human labor.

Moreover, the increasing availability of affordable sensors, AI-driven software, and cloud-based warehouse management systems (WMS) has made automation more accessible to businesses of all sizes. Even small and mid-sized companies are now exploring automation solutions to remain competitive in a rapidly changing marketplace.

Key Technologies Shaping the Market

Several technologies are central to the transformation of warehouse operations:

Robotics: Robotic systems are being widely used for picking, packing, and transporting goods within warehouses. These systems use machine learning and computer vision to navigate and perform tasks with high precision.

Automated Storage and Retrieval Systems (AS/RS): AS/RS use cranes, shuttles, and conveyors to store and retrieve products efficiently. These systems are especially beneficial in high-density storage environments.

Conveyor and Sortation Systems: These enable rapid sorting of packages based on size, weight, destination, or priority, which is essential in high-volume distribution centers.

Warehouse Management Software (WMS): A robust WMS integrates with hardware systems to provide real-time visibility into inventory, order status, and workforce productivity.

Internet of Things (IoT): Sensors and connected devices provide data on equipment performance, warehouse temperature, and stock levels, allowing predictive maintenance and better resource management.

Market Outlook and Growth Trends

According to market analysts, the warehouse automation market is expected to continue its robust growth trajectory over the next decade. Valued at approximately $22 billion in 2024, it is projected to surpass $60 billion by 2030, growing at a compound annual growth rate (CAGR) of over 14%.

Geographically, North America and Europe have been early adopters of warehouse automation, driven by well-established logistics infrastructure and high labor costs. However, Asia-Pacific is rapidly catching up, fueled by booming e-commerce sectors in countries like China and India, as well as a strong push toward industrial modernization.

Industries beyond retail are also embracing automation. Sectors such as pharmaceuticals, food and beverage, and electronics are increasingly investing in warehouse technologies to meet stringent quality standards and ensure traceability throughout the supply chain.

Challenges to Implementation

Despite its benefits, warehouse automation is not without challenges. High upfront investment remains a significant barrier for many companies, particularly in emerging markets. Additionally, the complexity of integrating new technologies into existing systems can lead to downtime and operational disruptions during the transition phase.

There is also the issue of workforce displacement. While automation reduces the need for manual labor, it also necessitates upskilling workers to manage and maintain automated systems. Companies must invest in training and change management to ensure a smooth technological transition.

Cybersecurity is another growing concern. As warehouses become more digitally connected, the risk of cyberattacks increases. Ensuring robust data protection and system security is critical for preventing operational disruptions and safeguarding sensitive information.

The Road Ahead

The warehouse automation market is at a pivotal juncture. As technological capabilities expand and the cost of automation continues to decline, its adoption will become increasingly widespread. Businesses that embrace automation early stand to gain a competitive edge through improved efficiency, reduced operational costs, and enhanced customer satisfaction.

However, success in this space requires more than just investment in hardware and software. It demands a holistic strategy that includes employee training, supply chain integration, and a commitment to continuous innovation. By reimagining warehouse operations through the lens of automation, companies can not only meet today’s demands but also build a more agile and resilient logistics ecosystem for the future.

0 notes

Text

0 notes

Text

0 notes

Text

Conveyor Roller Systems: The Complete Guide: Effectiveness and Creativity in Material Processing

Conveyor roller systems have revolutionized the material handling industry, offering efficiency, reliability, and cost-effectiveness. Whether in warehouses, manufacturing plants, or distribution centers, these systems play a vital role in streamlining logistics. This guide explores conveyor roller systems in-depth, covering types, benefits, and key considerations when selecting the right system for your needs.

What Are Conveyor Roller Systems?

A conveyor roller system is a mechanical assembly designed to transport materials effortlessly across a defined path. It consists of rollers, frames, and a drive system that work together to move goods efficiently. These systems are commonly used in industries such as logistics, food processing, mining, and e-commerce fulfillment centers.

Types of Conveyor Roller Systems

Conveyor roller systems come in different variations, each designed for specific applications. Understanding their differences helps businesses choose the right solution for their operational needs.

1. Gravity Roller Conveyors

Operate without external power.

Relies on gravity to move items.

Ideal for lightweight packages and manual operations.

2. Powered Roller Conveyors

Uses motors or belt drives to transport materials.

Suitable for high-speed and automated operations.

Offers better control over material movement.

3. Chain-Driven Roller Conveyors

Uses chains to rotate rollers.

Best for heavy-duty applications such as automotive and industrial manufacturing.

Provides robust durability and load capacity.

4. Belt-Driven Roller Conveyors

Features a belt running beneath the rollers for movement.

Great for fragile or irregularly shaped items.

Used in applications requiring precise product handling.

5. Flexible Roller Conveyors

Can expand, contract, and curve as needed.

Excellent for temporary or space-limited workspaces.

Common in retail, e-commerce, and parcel distribution centers.

Key Benefits of Conveyor Roller Systems

Investing in a conveyor roller system provides a range of benefits that enhance operational efficiency.

1. Increased Productivity

Automating material handling reduces manual labor, ensuring faster throughput and increased efficiency in manufacturing and distribution processes.

2. Reduced Labor Costs

By minimizing manual handling, businesses can cut labor expenses while improving workplace safety.

3. Improved Accuracy and Consistency

Conveyor roller systems reduce errors and inconsistencies that often occur in manual handling, leading to better inventory management and order fulfillment.

4. Versatility in Applications

These systems can handle various materials, including boxes, pallets, and bulk materials, making them adaptable for diverse industries.

5. Enhanced Workplace Safety

By automating movement, conveyor systems reduce workplace injuries related to heavy lifting and repetitive strain.

Real-World Applications and Testimonials

Many businesses have successfully integrated conveyor roller systems into their operations, experiencing remarkable improvements in productivity and efficiency.

Case Study: E-commerce Distribution Center

A leading online retailer implemented a powered roller conveyor system to handle high order volumes. The result? A 40% increase in order processing speed and a significant reduction in manual labor costs.

Testimonial: Manufacturing Industry

“After installing a chain-driven roller conveyor, our production line became 30% faster with fewer material handling errors. It has been a game-changer for our efficiency.” – Operations Manager, Automotive Manufacturer

Future Trends in Conveyor Roller Systems

With advancements in automation and AI, conveyor roller systems are evolving to become smarter and more efficient. Here are some future trends to watch:

IoT-Enabled Monitoring – Smart conveyors with sensors provide real-time analytics on system performance and maintenance needs.

AI-Powered Sorting – Artificial intelligence helps improve sorting accuracy and operational efficiency.

Sustainability Improvements – Energy-efficient motors and recyclable materials are making conveyor systems more eco-friendly.

Conclusion

Conveyor roller systems are an indispensable asset in material handling, providing unparalleled efficiency and reliability. Whether for a small warehouse or a large manufacturing plant, choosing the right system can significantly improve operations. By understanding the different types, benefits, and industry applications, businesses can optimize their workflows and stay competitive in a fast-paced market.

0 notes

Text

0 notes

Text

Warehouse Automation: 2025 Trends, Types, and Best Practices

Warehouse automation, a cornerstone of the fourth industrial revolution, is transforming logistics by enhancing efficiency, accuracy, and scalability. Technologies like robotic pickers, conveyor belts, and AI-driven systems reduce manual labor and streamline operations to meet soaring e-commerce demands. As global retail sales are projected to hit $7.4 trillion by 2025, automation is critical for staying competitive. This 700-word guide explores the benefits, types, trends, and best practices for warehouse automation in 2025.

What is Warehouse Automation?

Warehouse automation leverages advanced technologies—robotics, software, and automated systems—to optimize tasks with minimal human involvement. It replaces repetitive, error-prone manual processes with faster, more accurate solutions. For instance, robotic arms sort goods, while conveyor systems move items seamlessly, saving time, cutting costs, and boosting efficiency in today’s fast-paced logistics landscape.

Benefits of Warehouse Automation

Enhancing Efficiency and Productivity

Automation streamlines workflows, accelerating tasks like storage and retrieval. Automated Storage and Retrieval Systems (AS/RS) maximize space, while robotic pick-and-pack stations enable rapid order fulfillment, supporting services like overnight shipping. Operating 24/7, automated systems reduce bottlenecks and boost productivity.

Reducing Errors and Improving Accuracy

Technologies like barcode readers achieve near-100% data capture, eliminating picking and tracking errors. Real-time monitoring ensures accurate inventory, and precise systems deliver 99.9% picking accuracy, minimizing costly mistakes and enhancing order reliability.

Lowering Operational Costs

Automation reduces labor and material waste, offering significant savings. AS/RS systems provide a 3–5-year payback period and can last 30 years, optimizing resources. By automating repetitive tasks, businesses lower operational expenses and achieve sustainable cost reductions.

Scaling Operations Seamlessly

Automated solutions adapt to seasonal spikes or growth without major overhauls. Scalable systems like Autonomous Mobile Robots (AMRs) integrate new technologies, ensuring warehouses remain agile in dynamic markets.

Types of Warehouse Automation Technologies

Collaborative Robots (Cobots)

Cobots work alongside humans, handling repetitive tasks like sorting or packing. Equipped with safety sensors, they prevent collisions and free workers for complex duties, such as quality checks, improving efficiency and safety.

Autonomous Mobile Robots (AMRs)

AMRs use AI and sensors to navigate warehouses, transporting goods precisely. Integrated with Warehouse Management Systems (WMS), they enhance inventory tracking, reduce labor costs, and operate 24/7 to support peak periods.

Conveyor and Sortation Systems

Conveyor belts and sortation systems use barcode scanners and RFID to move and sort goods efficiently, streamlining picking, packing, and shipping while reducing manual labor.

Automated Storage and Retrieval Systems (AS/RS)

AS/RS use robots or cranes to store and retrieve items, maximizing vertical space and speeding up inventory management. Integrated with WMS, they reduce congestion and boost throughput.

Key Trends in Warehouse Automation for 2025

Advancements in Robotics

Robots now handle picking, packing, and sorting with 99.9% accuracy. AI and machine learning enable them to manage complex tasks, like handling delicate items. The robotic picking market is expected to reach $5.7 billion by 2028.

Growth of AI Applications

AI optimizes restocking and demand forecasting, preventing stockouts and overstocking. AI-driven systems enhance quality control and adapt to customer demands, integral to modern WMS.

Increasing IoT Connectivity

IoT sensors provide real-time data on equipment and inventory, minimizing downtime via predictive maintenance and streamlining workflows for seamless operations.

Adoption of Predictive Analytics

Predictive analytics tools forecast demand, reducing inventory costs (averaging $3.7 million annually). They drive smarter decisions and faster ROI.

Sustainable Automation

Energy-efficient conveyors and AI-driven energy management reduce environmental impact, aligning with green logistics demands.

Steps to Implement Warehouse Automation

Assess Processes: Identify inefficiencies, like slow picking, to prioritize automation’s impact.

Set Goals: Define targets, such as 20% higher order accuracy, aligned with business needs.

Choose Tools: Select scalable solutions like AGVs or robotic arms, balancing cost and ROI.

Pilot Test: Start small in a low-traffic area, measuring metrics like processing time.

Train Workforce: Upskill staff on WMS and robotics for smooth adoption.

Implement in Phases: Begin with simple tasks like barcode scanning, progressing to robotic sorting.

Monitor and Optimize: Track KPIs like order accuracy and adjust workflows to maintain efficiency.

Overcoming Challenges

High Costs: Use financing or grants to offset investments. Solutions like Pio achieve 99.9% accuracy, reducing long-term costs.

Change Resistance: Involve staff, highlight benefits like less physical strain, and share success stories.

Compatibility: Assess systems and test integrations to ensure seamless operation.

Downtime: Schedule implementations during low-demand periods and monitor early stages.

Calculating ROI

Cost Savings: Automation cuts labor and error-related costs, with savings outweighing investments in 2–3 years.

Productivity: Sorting systems process thousands of packages hourly, far surpassing manual labor.

Error Reduction: Accurate systems boost customer retention, as 17% of consumers abandon brands after one error.

Scalability: Dynamic systems handle growth without reinvestment.

Conclusion

Warehouse automation delivers faster, more accurate, and cost-effective operations. Technologies like cobots, AMRs, and AI enable warehouses to meet e-commerce demands and scale efficiently. By starting small, integrating with WMS, and training staff, businesses can maximize ROI and overcome challenges. With the automation market projected to reach $69 billion by 2025, now is the time to invest for sustainable success.

1 note

·

View note

Text

Automated Sortation System Market

📦 𝐅𝐫𝐨𝐦 𝐂𝐡𝐚𝐨𝐬 𝐭𝐨 𝐂𝐥𝐚𝐫𝐢𝐭𝐲 ➡️ 𝐎𝐧𝐞 𝐒𝐜𝐚𝐧 𝐚𝐭 𝐚 𝐓𝐢𝐦𝐞 🔄

Automated Sortation System Market size is estimated to reach $12 Billion by 2031, growing at a CAGR of 9.2% during the forecast period 2025–2031.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

Automated Sortation System Market is a rapidly growing segment within the logistics and material handling industry, driven by the increasing demand for speed, accuracy, and efficiency in supply chain operations. These systems are used to identify, categorize, and route products or packages using technologies such as barcode scanners, RFID, sensors, and advanced software algorithms.

Key industries adopting automated sortation systems include e-commerce, retail, postal and courier services, food and beverage, and pharmaceuticals, where high-volume handling and timely delivery are critical. The surge in online shopping and global trade has significantly contributed to market expansion, with warehouses and distribution centers investing in automation to manage the growing volume and complexity of operations.

Technological advancements - such as AI-powered sorting, IoT integration, and real-time data analytics - are enhancing the performance of these systems, offering greater flexibility, scalability, and predictive maintenance capabilities. Moreover, the emphasis on labor cost reduction, operational efficiency, and error minimization is accelerating adoption across developed and emerging economies.

Regionally, North America and Asia-Pacific are leading markets, with substantial investments in infrastructure modernization. The market is expected to maintain strong growth momentum, supported by continuous innovation and the global push toward digital and automated supply chains.

𝐓𝐨𝐩 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

Daifuku North America, INCAS - SSI SCHÄFER GROUP, BEUMER Group, Interroll Group, Körber, Siemens Logistics, Fives Intralogistics , Murata Machinery USA, Inc, Dematic Mobile Automation, Vanderlande, Bastian Solutions, TGW Logistics, System Logistics Corporation - Vertique (Krones Group), Equinox MHE, MHS Global, Conveyco Technologies, Intralox, FlexLink

#AutomatedSortation #SortationSystems #WarehouseAutomation #SmartLogistics #MaterialHandling #IndustrialAutomation #SupplyChainTech #AutomationSolutions #Intralogistics #LogisticsInnovation

0 notes

Text

Parcel Sortation Systems: Driving the Future of Automated Logistics

The global parcel sortation system market was valued at USD 2.2 billion in 2023 and is projected to grow to USD 3.1 billion by 2034, representing a compound annual growth rate (CAGR) of 3.1% over the forecast period (2024–2034). Parcel sortation systems are automated solutions designed to detect, sort, and route various types of packages based on predefined criteria such as size, weight, destination, or barcode data. These systems play a critical role in modern logistics, warehousing, e-commerce, and airport operations by optimizing order fulfillment and improving operational efficiency.

According to industry analysts, the steady growth of the parcel sortation system market is driven primarily by the surge in online shopping and the rapid adoption of automated sorting technologies. Leading vendors are increasingly integrating AI-driven analytics, machine learning algorithms, and advanced robotics to fully automate the sortation process. These innovations not only enhance throughput rates but also significantly reduce labor costs and order errors.

Market Drivers & Trends

Surge in Online Shopping: E-commerce giants and retail players are witnessing unprecedented package volumes. For example, Amazon Logistics alone shipped approximately 4.8 billion packages in 2022, averaging over 13 million deliveries per day. This boom in online retail necessitates scalable sortation infrastructures to process high volumes with accuracy and speed.

Adoption of Automated Parcel Sorting Robots: The transition from manual sorting to robotic and AI-powered solutions is accelerating. Automated guided vehicles (AGVs), robotic arms, and crossbelt sorters enhance the flexibility and reliability of warehouse and distribution centers.

Labor Shortages & Cost Reduction: Rising labor costs and workforce scarcity are prompting companies to invest in automation. Automated sortation systems offer long-term operational savings and can be redeployed to perform higher-value tasks.

Integration of AI & Data Analytics: Predictive maintenance, real-time monitoring, and dynamic routing are now feasible thanks to data-driven platforms. These systems help preempt equipment failures and optimize workflow.

Latest Market Trends

Hybrid Sorting Solutions: Combining multiple sorter types (e.g., crossbelt, tilt-tray, and pop-up sorters) in a single system to handle diverse parcel dimensions and fragility levels.

Last-Mile Optimization: Sortation systems integrated with route-planning software to accelerate delivery times and reduce transportation costs.

Cloud-Based Control Platforms: SaaS offerings that allow remote monitoring and performance analytics of sortation assets across multiple sites.

Sustainability Initiatives: Energy-efficient conveyors and recyclable sorter components are gaining traction in response to corporate ESG commitments.

Key Players and Industry Leaders Major vendors in the parcel sortation system market include:

Daifuku Co. Ltd.: Pioneer in automated warehouse solutions, with recent investments in ML-based sortation intelligence.

Dematic: Offers modular sortation lines and turnkey warehouse automation services.

GreyOrange: Known for its AI-driven Butler robotics and Rian sorter systems.

Bastian Solutions, LLC: Specializes in conveyors, sortation, and integration services.

Siemens Logistics GmbH: Provides end-to-end sortation solutions, from barcode scanners to crossbelt sorters.

Beumer Group: Developer of the PSL crossbelt sorter and energy-optimized automated systems.

Honeywell International Inc.: Integrates voice-guided picking with automated sortation for e-commerce fulfillment.

Unlock crucial data and key findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=62082

Recent Developments

January 2024: Viettel Post deployed 160 LiBiao ‘Mini Yellow’ autonomous guided robots at its Hanoi distribution hub, resulting in a 30% increase in sorting throughput and 20% reduction in sorting errors.

February 2024: Daifuku Intralogistics India showcased its fully automated warehouse solutions at LogiMAT India 2024, featuring virtual reality demonstrations of sorting transfer vehicles and AS/RS integration.

August 2023: Falcon Autotech partnered with DTDC Express to automate parcel sorting at DTDC’s 1.7 million sq. ft. super hub in Chennai, deploying high-speed crossbelt sorters capable of processing 25,000 parcels per hour.

Market Opportunities

Expansion in Emerging Economies: Asia Pacific and Latin America present significant growth potential as e-commerce adoption accelerates and infrastructure investments increase.

SME-Oriented Solutions: Scalable, cost-effective sortation modules tailored for small-to-mid-sized logistics providers.

Aftermarket Services: Remote monitoring, predictive maintenance, and training services for optimized system uptime.

Collaboration with Last-Mile Delivery Providers: Integrating sortation systems directly with delivery fleet management platforms to close the logistics loop.

Future Outlook Looking ahead to 2034, the parcel sortation system market is expected to benefit from:

5G-enabled IoT Connectivity: Real-time asset tracking within warehouses and distribution centers.

Autonomous Mobile Robots (AMRs): Flexible sortation workflows that adapt to changing parcel profiles and order mix.

Blockchain for Provenance: Secure, immutable records of parcel movement to meet regulatory requirements, especially in pharmaceuticals.

Augmented Reality (AR) for Maintenance: Technician support through AR overlays to reduce downtime during repairs.

Market Segmentation

By Offering:

Hardware: Conveyors, sensors, scanners, sorters.

Software: Warehouse execution systems, sortation control software.

Services: Implementation, training, maintenance.

By Type:

Case Sorters

Pop-up Sorters

Shipping Carton Sorters

Pivoting Arm Sorters

Pusher Sorters

Tilt Tray Sorters

Crossbelt Sorters

Pouch Sorters

Others

By End-Use:

Logistics

E-commerce

Airports

Pharmaceuticals

Food & Beverages

Others (Healthcare, etc.)

Regional Insights

North America: Leading region with the highest market share in 2023, driven by consumer demand for same-day/next-day delivery and significant automation investments in U.S. and Canada.

Europe: Strong growth owing to high e-commerce penetration (82% of U.K. consumers made online purchases in 2021) and the adoption of AI/ML for sortation optimization.

Asia Pacific: Emerging distribution hubs in China, India, and ASEAN countries are investing in modern fulfillment centers equipped with advanced sortation technologies.

Middle East & Africa: Growing retail infrastructure and government initiatives to enhance supply chain resilience.

South America: Increasing e-commerce activities in Brazil and Argentina creating demand for small-scale sortation solutions.

Why Buy This Report?

Comprehensive Coverage: Detailed quantitative and qualitative analysis including market drivers, restraints, opportunities, and key trends.

Strategic Insights: In-depth profiles of 15+ leading players, including their product portfolios, financial overviews, and recent developments.

Robust Forecasting: Market projections through 2034, with historical data (2020–2022) to contextualize growth trajectories.

Actionable Recommendations: Market entry strategies, investment opportunities, and aftermarket service models.

Customizable Data: Interactive PDFs and Excel workbooks with segment-level data and regional break-downs.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes